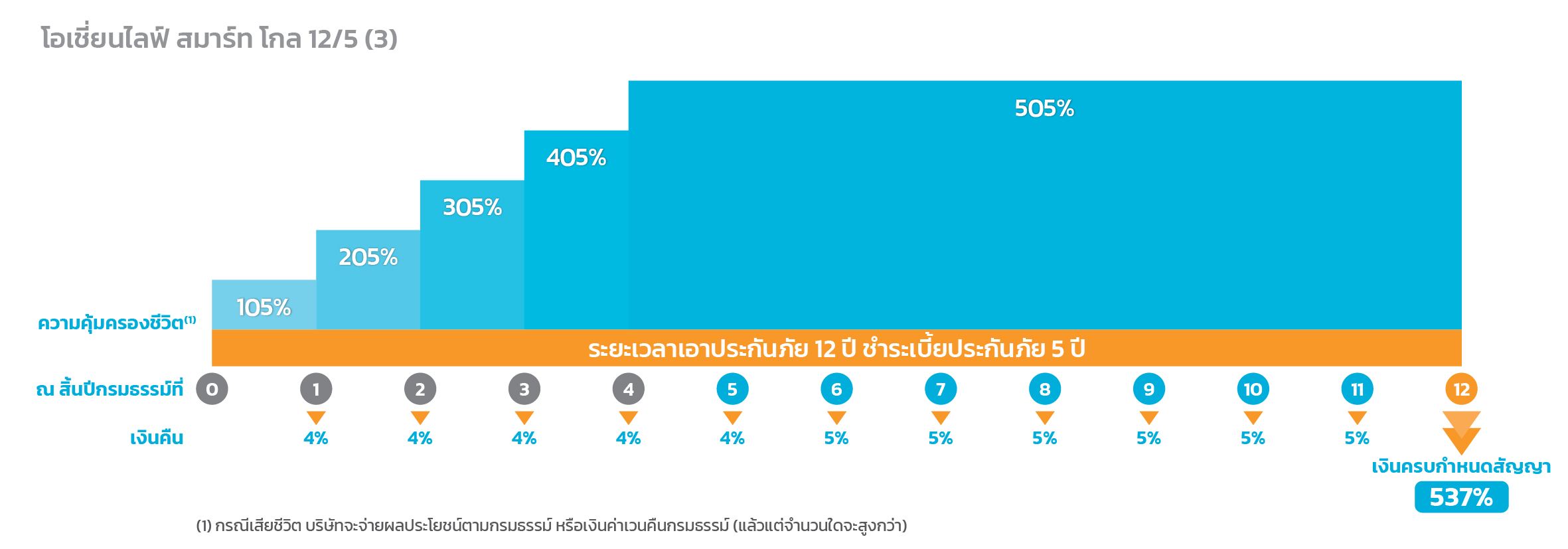

Ocean Life Smart Goal 12/5 (3)

Life Coverage

Guaranteed cash back

Tax Deductible

Introduction of Insurance

Insurable Age

Sum Assured

Premium Payment Mode

Rider Attachment

Excluding the Waiver of Premium (WP) benefit rider

Medical Examination

Tax Deduction Eligibility

Coverage and Benefit

Conditions of Insurance

12 years / 5 years

Examples of Exclusions

The following exclusions are only some parts of all exclusions stated in the insurance policy:

1. In case of non-declare or misrepresentation, the company has the right to void the insurance policy and not paying for the benefits stated in the insurance policy.

2. Committing suicide within 1 year since the effective date or the latest reinstatement date.

3. Being killed by a beneficiary.

4. Misrepresentation of the exact age and it is proven that the exact age on the contract date is not in the range of eligible age, etc.

Q : What is suitable for the OCEAN LIFE Smart Goal 12/5 (3)?

A : It is suitable for individuals who wish to plan their savings for future financial needs and take advantage of personal income tax deductions.

Q : Is a health check-up required when applying for the OCEAN LIFE Smart Goal 12/5 (3)?

A : According to the Company's rules.

Q : Can the premiums paid for OCEAN LIFE Smart Goal 12/5 (3) be used for tax deduction purposes?

A : Eligible for personal income tax deduction of up to 100,000 Baht

Q : What are the minimum and maximum sum insured amounts for the OCEAN LIFE Smart Goal 12/5 (3)?

A : - Minimum sum insured: 100,000 Baht

- Maximum sum insured: 20,000,000 Baht per insured person

Q : Can additional riders be attached to the OCEAN LIFE Smart Goal 12/5 (3) policy?

A : Yes, riders can be added in accordance with the Company’s underwriting guidelines, excluding the Waiver of Premium (WP) benefit rider.

Q: What is the total benefit payable throughout the policy term under OCEAN LIFE Smart Goal 12/5 (3)?

A: Total benefits payable throughout the policy term amount to 587% of the sum assured

- % means the percentage of the sum assured.

- Underwriting is subject to the Company’s terms and conditions.

- Benefits and coverage are subject to the health insurance policy’s terms and conditions.

- Tax Deduction according to the rules prescribed by the Revenue Department

- This is only basic information. An insured should read aware of coverage condition, benefits, and exclusions of an insurance policy.