OCEAN LIFE Love Protect 77/7

Live confidently and fully while doing what you love—for yourself,

while at the same time caring for and protecting the future of those you love.

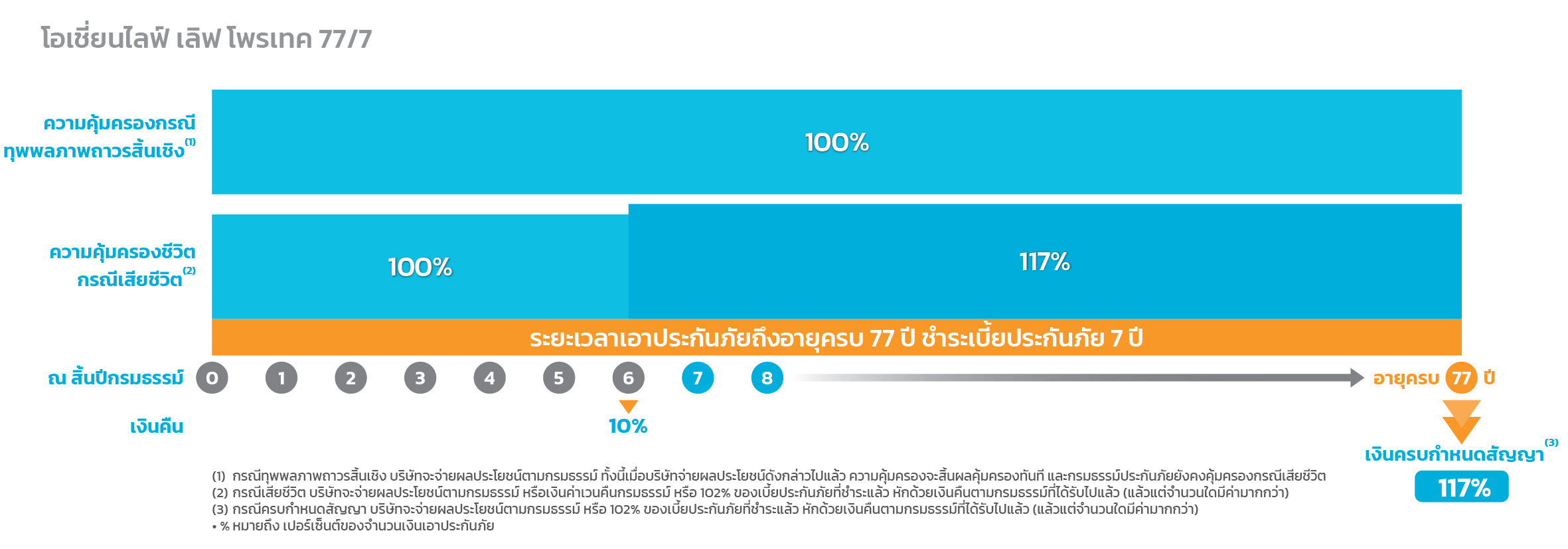

OCEAN LIFE Love Protect 77/7

An endowment insurance designed to meet the needs of today’s working generation.

With a short premium payment period of just 7 years, the plan is completed quickly and does not create a long-term burden, while life protection continues all the way until age 77.

Throughout the journey until you attain age 77, this policy serves as a foundation of protection for your loved ones. And as you live happily and confidently doing what you love, free from worry, when you reach age 77, the policy returns as a lump sum—ready for you to use in planning the next stage of your life with purpose and value, without being a burden to anyone.

Plan ahead to pass on a lump sum to your loved ones

from policy year 7 until the policyholder reaches age 77

Total and Permanent Disability (TPD) coverage of 100%(2) throughout the entire policy term

Feel confident about the future with a guaranteed lump sum

Tax Deductible

Introduction of Insurance

Insurable Age

Sum Assured

Premium Payment Mode

Rider Attachment

Medical Examination

Tax Deduction Eligibility

| จ่ายเบี้ยประกันภัย 7 ปี ปีละ (บาท) |

จำนวนเงิน เอาประกันภัย (บาท) |

ผลประโยชน์เงินคืนกรณีมีชีวิตอยู่ | ตัวอย่างผลประโยชน์กรณีเสียชีวิต หรือทุพพลภาพถาวรสิ้นเชิง (บาท) | ผลประโยชน์ส่วนต่าง เทียบเบี้ยที่จ่าย รวมตลอดสัญญา (บาท) |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| รับเงินคืน ณ สิ้นปีกรมธรรม์ที่ 6 |

รับเงิน ครบกำหนดสัญญา(3) ณ สิ้นปีกรมธรรม์ ที่มีอายุครบ 77 ปี |

ผลประโยชน์กรณีเสียชีวิต ตั้งแต่ปีกรมธรรม์ที่ 7 ถึงปีกรมธรรม์ที่มีอายุครบ 77 ปี(1) |

ผลประโยชน์กรณี ทุพพลภาพถาวรสิ้นเชิง(2) |

|||||||

| บาท | % | บาท | % | บาท | % | บาท | % | |||

| 13,100 | 100,000 | 10,000 | 10% | 117,000 | 117% | 117,000 | 117% | 100,000 | 100% | 35,300 |

| 38,700 | 300,000 | 30,000 | 10% | 351,000 | 117% | 351,000 | 117% | 300,000 | 100% | 110,100 |

| 64,500 | 500,000 | 50,000 | 10% | 585,000 | 117% | 585,000 | 117% | 500,000 | 100% | 183,500 |

| 90,300 | 700,000 | 70,000 | 10% | 819,000 | 117% | 819,000 | 117% | 700,000 | 100% | 256,900 |

| 127,000 | 1,000,000 | 100,000 | 10% | 1,170,000 | 117% | 1,170,000 | 117% | 1,000,000 | 100% | 381,000 |

| 190,500 | 1,500,000 | 150,000 | 10% | 1,755,000 | 117% | 1,755,000 | 117% | 1,500,000 | 100% | 571,500 |

ตั้งแต่ปีกรมธรรม์ที่ 7 ถึงปีกรมธรรม์ที่มีอายุครบ 77 ปี

ตั้งแต่ปีกรมธรรม์ที่ 1 ถึงปีกรมธรรม์ที่มีอายุครบ 77 ปี

• เมื่อครบกำหนดสัญญารับเงินครบกำหนดสัญญา 117%(3)

ที่ต้องการสร้างหลักประกันให้ลูก

- ต้องการวางแผนการออมเงิน(4) เพื่อสร้างเงินก้อนในอนาคต นำไปใช้เป็นทุนสำรองและรองรับแผนชีวิตระยะยาว

- ต้องการวางแผนป้องกันความเสี่ยง เพื่อให้ครอบครัว

ไม่เดือดร้อนหากเกิดเหตุการณ์ไม่คาดฝัน

ที่ต้องการสร้างหลักประกันให้พ่อแม่

- เป็นผู้หารายได้หลักของครอบครัว ดูแลพ่อแม่วัยเกษียณต้องการวางแผนอนาคต เพื่อไม่ให้พ่อแม่ต้องกังวลหากเกิดเหตุไม่คาดฝัน

- อยากออมเงิน(4) และมีเงินก้อนในอนาคต เพื่อใช้เป็นทุนสำหรับวางแผนชีวิตระยะยาว

Coverage and Benefit

เพิ่มความอุ่นใจรอบด้าน สามารถทำคู่กับสัญญาเพิ่มเติมได้ตามต้องการ

ความคุ้มครองสุขภาพ แนบคู่

เอ็นจอย เฮลท์ เอ็กซ์ตร้า Enjoy Health Extra

- คุ้มครองค่ารักษาพยาบาลเหมาจ่าย สูงสุด 5 ล้านบาท/ครั้ง *

- ครอบคลุมค่าห้องพักเดี่ยวมาตรฐาน

- รับเงินชดเชยรายวัน** หากไม่เคลมผลประโยชน์ผู้ป่วยใน (IPD)

- คุ้มครองค่าล้างไต รังสีรักษา เคมีบำบัด รวมถึง Targeted therapy

- จ่ายเบี้ยถูกลง เมื่อเลือกแผนแบบมีความรับผิดส่วนแรก

* เมื่อทำประกันสัญญาเพิ่มเติมคุ้มครองสุขภาพเอ็นจอย เฮลท์ เอ็กซ์ตร้า (Enjoy Health Extra) แผน 3 (D0/ D20,000/ D50,000/ D100,000)

** สำหรับแบบไม่มีความรับผิดส่วนแรก (D0) กรณีเป็นผู้ป่วยในแต่ไม่ได้เรียกร้องผลประโยชน์กรณีเป็นผู้ป่วยใน จากสัญญาเพิ่มเติมคุ้มครองสุขภาพเอ็นจอย เฮลท์ เอ็กซ์ตร้า (Enjoy Health Extra)

- โอเชี่ยนไลฟ์ เอ็นจอย เฮลท์ เอ็กซ์ตร้า เป็นชื่อทางการตลาดของสัญญาเพิ่มเติมคุ้มครองสุขภาพเอ็นจอย เฮลท์ เอ็กซ์ตร้า (Enjoy Health Extra)

- ห้องพักเดี่ยวมาตรฐาน หมายถึง ห้องพักเดี่ยวราคาเริ่มต้นของโรงพยาบาล

- ความรับผิดส่วนแรก (Deductible) หมายถึง ความเสียหายส่วนแรกที่ผู้เอาประกันภัยต้องรับภาระตามข้อตกลงของสัญญาประกันภัย

- ความคุ้มครองและการจ่ายผลประโยชน์ต่าง ๆ เป็นไปตามที่กำหนดไว้ในกรมธรรม์

- โปรดทำความเข้าใจเงื่อนไข ความคุ้มครองก่อนตัดสินใจทำประกันทุกครั้ง

ความคุ้มครองโรคร้ายแรง แนบคู่

ซูเปอร์ ซีไอ 120 CI120

- คุ้มครองโรคร้ายแรงสูงสุด 120 โรค

- คุ้มครอง 6 กลุ่มโรค + ความคุ้มครองพิเศษกลุ่มโรคมะเร็ง*

- คุ้มครองต่อเนื่อง หากตรวจพบโรคร้ายแรงใหม่ในกลุ่มโรคอื่น

- คุ้มครองค่าล้างไต รังสีรักษา เคมีบำบัด รวมถึง Targeted therapy

- เคลมครบ 100% ของกลุ่มโรคใดกลุ่มหนึ่ง ไม่ต้องจ่ายเบี้ยต่อ**

* กรณีที่ผู้เอาประกันภัยได้รับการวินิจฉัย และ/หรือยืนยันจากแพทย์ ว่าป่วยเป็นโรคมะเร็งระยะลุกลามในกลุ่มความคุ้มครองพิเศษของโรคมะเร็งระยะลุกลามในกลุ่มที่ 1 สำหรับเพศชายหรือเพศหญิง

**บริษัทจะจ่ายผลประโยชน์สูงสุดต่อกลุ่มโรคร้ายแรงไม่เกิน 100% รวมผลประโยชน์สูงสุดไม่เกิน 600% และคุ้มครองเพิ่มเติมสำหรับกลุ่มความคุ้มครองพิเศษของโรคมะเร็งระยะลุกลามในกลุ่มที่ 1 สูงสุด 100% รวมสูงสุด 700%

- โอเชี่ยนไลฟ์ ซูเปอร์ ซีไอ 120 เป็นชื่อทางการตลาดของสัญญาเพิ่มเติมโอเชี่ยนไลฟ์ ซูเปอร์ ซีไอ 120 (CI120)

- ความคุ้มครองและการจ่ายผลประโยชน์ต่าง ๆ เป็นไปตามที่กำหนดไว้ในกรมธรรม์

- โปรดทำความเข้าใจเงื่อนไข ความคุ้มครองก่อนตัดสินใจทำประกันทุกครั้ง

ความคุ้มครองอุบัติเหตุ แนบคู่

คุ้มครองอุบัติเหตุพิเศษ CPA EXtra

- คุ้มครองค่ารักษาพยาบาลต่ออุบัติเหตุแต่ละครั้ง สูงสุด200,000บาท*

- ไม่ต้องสำรองจ่าย เมื่อใช้บริการในโรงพยาบาลเครือข่าย

- คุ้มครองกรณีเสียชีวิตจากอุบัติเหตุรับสูงสุด 2,000,000 บาท*

- คุ้มครองกรณีเสียชีวิตจากอุบัติเหตุสาธารณะ รับเพิ่มอีก 1 เท่า รวมรับ 4,000,000 บาท*

* กรณีเลือกทำจำนวนเงินเอาประกันภัย 2,000,000 บาท

- ความคุ้มครองและการจ่ายผลประโยชน์ต่าง ๆ เป็นไปตามที่กำหนดไว้ในกรมธรรม์

- โปรดทำความเข้าใจเงื่อนไข ความคุ้มครองก่อนตัดสินใจทำประกันทุกครั้ง

Conditions of Insurance

Coverage until attaining the age of 77 / 7 year

Examples of Exclusions

The following exclusions are only some parts of all exclusions stated in the insurance policy:

1. In case of non-declare or misrepresentation, the company has the right to void the insurance policy and not paying for the benefits stated in the insurance policy.

2. Committing suicide within 1 year since the effective date or the latest reinstatement date.

3. Being killed by a beneficiary.

4. Misrepresentation of the exact age and it is proven that the exact age on the contract date is not in the range of eligible age, etc.

Q : What is the eligible entry age for the OCEAN LIFE Love Protect 77/7?

A : 30 Days - 60 Years Old

Q: What premium payment modes are available for the OCEAN LIFE Love Protect 77/7?

A : Annual, semiannual, quarterly and monthly

Q : What are the minimum and maximum sum insured amounts for the OCEAN LIFE Love Protect 77/7?

A : - Minimum sum insured: 100,000 Baht (rounded to 1 Baht)

- Maximum sum insured: 20,000,000 Baht per insured person

Q : Does the OCEAN LIFE Love Protect 77/7 support annual premium payments via credit card?

A : Yes, Annual premium payments via credit card are supported, and the company will bear any applicable credit card fees.

Q : Can additional riders be attached to the OCEAN LIFE Love Protect 77/7 policy?

A : Yes, riders can be added in accordance with the company’s underwriting guidelines.

Q : Is a health check-up required when applying for the OCEAN LIFE Love Protect 77/7?

A : According to the Company's rules

Q : If the insured becomes totally and permanently disabled and the company has already paid the benefits, will the OCEAN LIFE Love Protect 77/7 policy remain in force?

A : Yes, the policy will remain in force. However, the coverage for total and permanent disability will terminate immediately, while the life coverage will continue.

(1) In the event of death, the Company will pay the greater of: the policy benefit, the surrender value, or 102% of total premiums paid (after deducting any benefits previously received).

(2) In the event of total and permanent disability, the Company will pay the policy benefit. Once this benefit is paid, the disability coverage will terminate immediately, while the policy will continue to provide coverage for death.

(3) Upon maturity of the policy, the Company will pay the greater of: the policy benefit, or 102% of total premiums paid (after deducting any benefits previously received).

- % means the percentage of the sum assured.

- Underwriting is subject to the Company’s terms and conditions.

- Benefits and coverage are subject to the health insurance policy’s terms and conditions.

- Tax Deduction according to the rules prescribed by the Revenue Department

- This is only basic information. An insured should read aware of coverage condition, benefits, and exclusions of an insurance policy.

Interested in purchasing insurance product ?

Check premiums or compare with our other insurance